tax on unrealized gains bill

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. President Bidens Fiscal Year 2023 budget includes a new tax on unrealized gains.

Biden S Proposed Tax On Unrealized Gains Of Wealthy Americans Draws Skepticism Fox Business

0000 0138.

. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. WASHINGTONA new annual tax on billionaires unrealized capital gains is. It would impose significant tax liability when first implemented as taxpayers would be required to pay taxes on assets they first acquired years or decades ago.

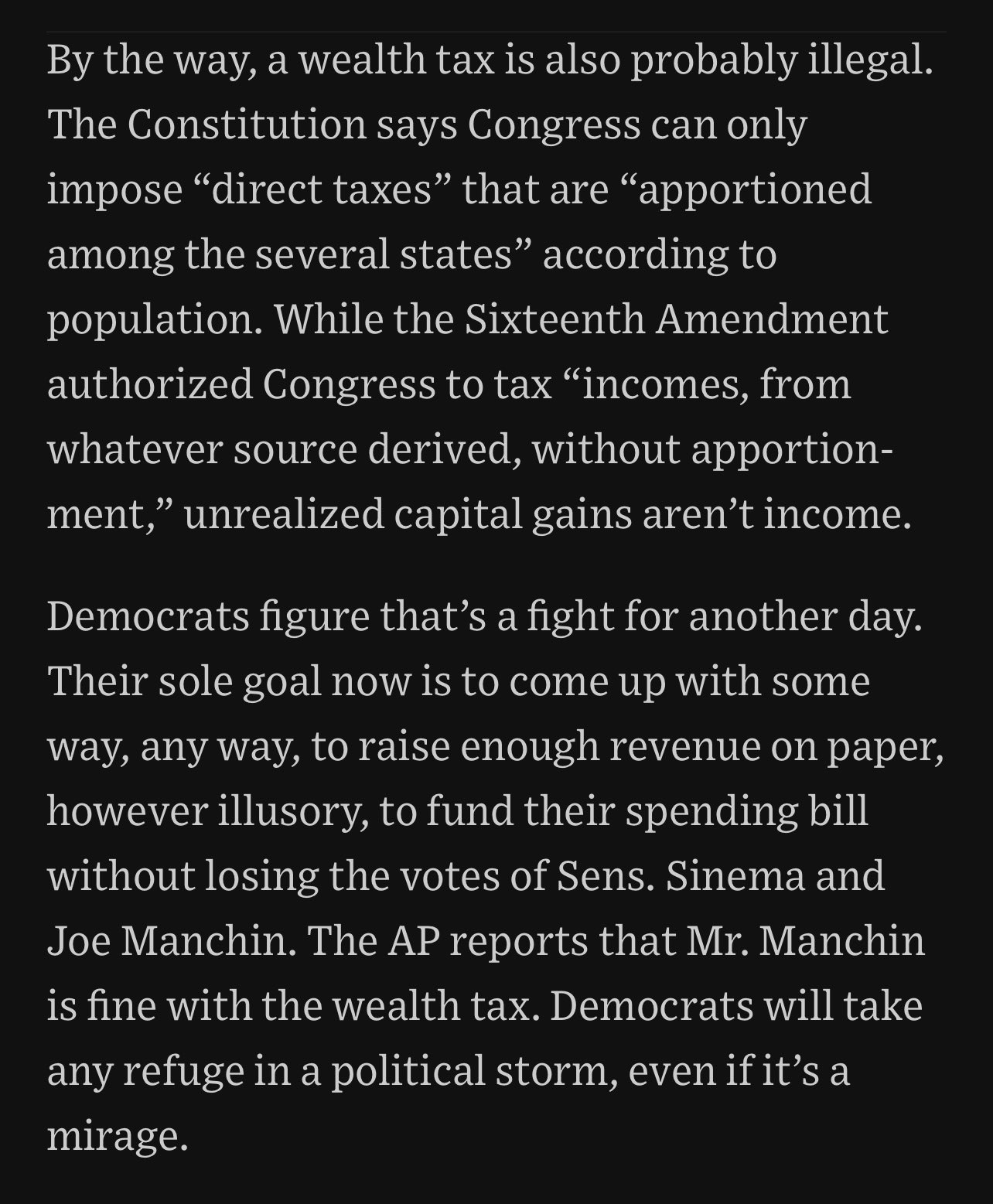

A tax on an increase on unrealized and of course possibly ephemeral gains is only on the most stretched of interpretations a tax on. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. This tax is just the latest attempt by the Democrats to reshape the tax code and pass a tax on.

A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by someone who cannotquoting the Pollock decisionshift the burden upon some one sic else. Any fair tax system would give that investor the ability to offset gains with losses as is generally the case elsewhere in the tax code. 4 hours agoPresident Bidens Fiscal Year 2023 budget calls for imposing an annual 20 percent tax on taxpayers with income and assets that exceed 100 million a.

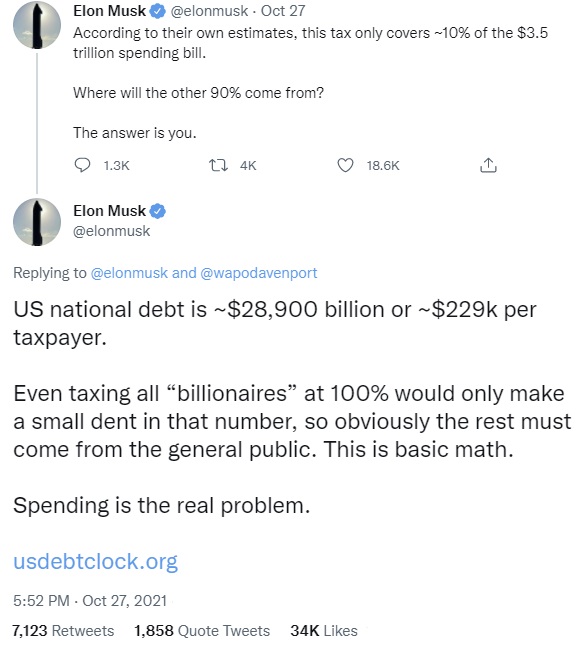

The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation on unrealized capital gains from any taxable asset including but not limited to covered and noncovered tradable assets gifts bequests and transfers in trust except to the extent that. Taxes Taxes Taxes It has already been a long year of new taxes tax hikes and even more tax proposals. Theres been a lot of debate this week over President Bidens latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires.

A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. In a CNN interview on Sunday Treasury Secretary Janet Yellen took pains to distinguish a billionaires tax -- a tax on unrealized capital gains of exceptionally wealthy individuals -- from a. March 26 2022 229 PM PDT President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US.

The impacted assets include stocks bonds real estate and art. This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase. This article is in your queue.

A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired. President Bidens 2 trillion spending package continues to stall as senior Democrats are hoping to finalize a proposal on a new annual tax. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of.

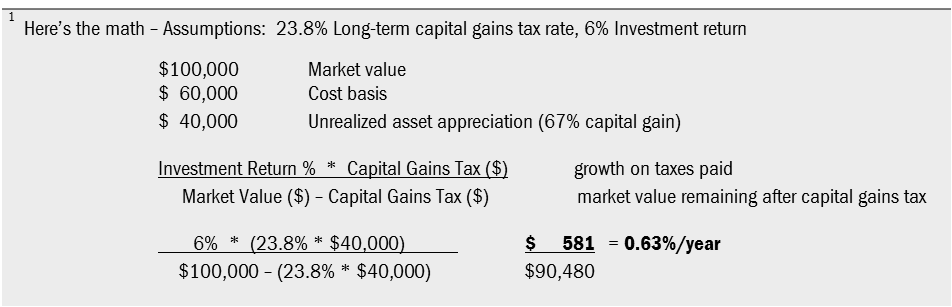

White House Unrealized Gains Tax Proposal For 2023 The Proposal adds a 20 minimum tax on the unrealized capital gains for households worth at least 100 million Biden again called to raise the corporate rate to 28 from 21 Individual income tax rates to 396 The budget also omitted a proposal to. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages.

High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. Households worth more than 100 million as. How might it change the best investment strategies.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on. A proposed House Ways and Means bill suggests raising capital gains tax rates to a maximum of 28 percent still lower than the top rate for income tax. The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income.

According to The Wall Street Journal.

Unrealized Capital Gains Tax Explained

The Unintended Consequences Of Taxing Unrealized Capital Gains Usgi

The Unintended Consequences Of Taxing Unrealized Capital Gains Usgi

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only

Cryptocurrency Discussion New Tax Proposal By Biden Administration Would Tax Unrealized Crypto Capital Gains Yearly Pumpdumpcoin Com

Biden S Proposed Tax On Unrealized Gains Of Wealthy Americans Draws Skepticism Fox Business

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Unrealized Capital Gains Tax Explained

Elon Musk S Warning On Government Spending And Unrealized Gains Tax Proposals Highlight Benefits Of Bitcoin Economy Bitcoin News Heromag

Lorde Edge And Unrealized Gains Tax No Safe Bets

An Inside Look At Biden S Proposed Unrealized Gains Tax Investment U

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

High Class Problem Large Realized Capital Gains Montag Wealth

Taxing Unrealized Capital Gains A Bad Idea National Review

Biden S Better Plan To Tax The Rich Wsj

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio

Tax On Billionaires Unrealized Gains Will Likely Be In Budget Package Democrats Say R Wallstreetbets

High Class Problem Large Realized Capital Gains Montag Wealth

Biden S Proposed Tax On Unrealized Gains Of Wealthy Americans Draws Skepticism Fox Business